The Stimulus Package: What you need to know

The Australian Government has recently released a number of support measures for individuals and businesses in response to the financial

impact of the Coronavirus. The measures are detailed below in 'The Stimulus package : What you need to know'. The Australian Government has

also announced a second stimulus package will be made available and details will be provided once known.

Each of the State Governments has also announced assistance packages for their constituents. The NSW State Government package includes the

following actions to assist small and medium businesses:

- waiving payroll tax for employers with payroll of less than $10 million for the quarter ended 30 June, 2020.

- waiving a range of fees and charges for small businesses including bars, cafes, restaurants and tradesmen.

- raising the payroll tax threshold to $1 million for the year ended 30 June, 2021.

Please call or email our team if you require any further information. We will keep you updated with changes as they occur.

What does the Stimulus Package mean for you?

The Government has announced a $17.6 billion investment package to support the economy as we brace for the impact of the coronavirus. The

yet to be legislated four part package focuses on business investment, sustaining employers and driving cash into the economy.

For business:

1. Business investment

- Increase and extension of the instant asset write-off

- Accelerated depreciation deductions

2. Cash flow assistance for small and medium sized business

- Tax-free payments up to $25,000 for employers

- Wage subsidy of up to 50% of an apprentice or trainee wage

3. Targeted support for severely affected sectors, regions and communities

For individuals:

4. Household stimulus payments to drive cash into the economy

- Tax-free $750 payment to social welfare recipients

Parliament sits on 23 March. The Prime Minister has stated, "we have no plans to change the parliamentary sitting schedule."

Here’s what we know so far:

Business investment

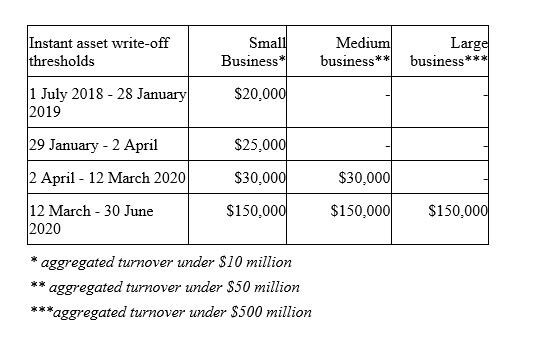

Increase and extension of the instant asset write-off

From 12 March 2020, the instant asset write-off threshold will increase from $30,000 to $150,000, and access to the write-off will be

expanded to include businesses with aggregated annual turnover of less than $500 million until 30 June 2020.

The instant asset write-off is a tax deduction that reduces the tax liability of your business. It enables your business to claim an

upfront deduction for depreciating assets in the year the asset was purchased and used (or installed ready to use). For example, if your

business is a base rate entity (turnover under $50m) in a company structure you will get back 27.5% in your 2019-20 company return if the

company acquires an asset that is used by 30 June 2020. If your business is likely to make a tax loss for the year, then the instant asset

write-off is unlikely to provide a short-term benefit to you. This is the fourth increase or extension to the instant asset write-off and

businesses will need to be wary of what they are claiming and when:

Instant asset write-off thresholds:

Assets will need to be used or installed ready for use from when the changes were announced on 12 March 2020 until by 30 June 2020 to

qualify for the higher threshold. Anything previously purchased does not qualify for the higher rate but may qualify for one of the other

thresholds. Similarly, anything purchased but not installed ready for use by 30 June 2020 will not qualify.

The instant asset write-off only applies to certain depreciable assets such as a concrete tank for a builder, a tractor for a farming

business, and a truck for a delivery business. You will also need ensure that there is a relationship between the asset purchased by the

business and how the business generates income. You can't for example just go and purchase multiple television sets if they have no

relevance to your business.

There are some assets that don't qualify such as horticultural plants, capital works (building construction costs etc.), assets leased to

another party on a depreciating asset lease, etc.

What businesses can access the instant asset write-off

To access the instant asset write-off, your business needs to be a trading business (the entity buying the assets needs to carry on a business in its own right). It also needs to have an aggregated turnover under $500 million. Aggregated turnover is the annual turnover of the business plus the annual turnover of any 'affiliates' or 'connected entities'. The aggregation rules are there to prevent businesses splitting their activities to access the concessions. Another entity is connected with you if:

- You control or are controlled by that entity; or

- Both you and that entity are controlled by the same third entity.

Accelerated depreciation deductions

In addition to the increased instant asset write-off rules, accelerated depreciation deductions will apply from 12 March 2020 until 30 June

2021. This will bring forward deductions that would otherwise be claimed in later years.

Businesses with a turnover of less than $500 million will be able to deduct 50% of the cost of the asset in the year of purchase. They can

also claim a further deduction in that year by applying the normal depreciation rules to the balance of the asset's cost. This will

presumably only be relevant if the business cannot already claim an immediate deduction for the full cost of the asset.

For example, let's assume that a business purchases a new truck for $250,000 (exclusive of GST) in July 2020. In the 2021 tax return the

business would claim an upfront deduction of $125,000. The business would also claim a further deduction for the depreciation that would

have arisen on the balance of the cost. If the business is a small business entity and using the simplified depreciation rules, this would

mean an additional deduction of $18,750 (i.e., 15% x $125,000). The total deduction in the 2021 tax return would be $143,750. Without the

introduction of this investment incentive the business would have claimed a deduction of $37,500 (i.e., 15% x $250,000).

This incentive will only be available in relation to new assets that are acquired after 12 March 2020 and are first used or installed ready

for use by 30 June 2021. It will not apply to second-hand assets or buildings and other capital works expenditure.

Cash flow assistance for small and medium sized business

Tax-free payments up to $25,000 for employers

Tax-free cash flow support between $2,000 and $25,000 will be available to eligible businesses with a turnover of less than $50 million that

employ staff between 1 January 2020 and 30 June 2020.

This is not a direct cash payment but a credit equal to 50% of the PAYG amounts withheld from salary and wages paid to employees. The

employer will need to lodge an activity statement to trigger the entitlement. If the credit puts the business in a refund position the

excess amount will be refunded by the ATO within 14 days. If a business pays salary and wages to employees but is not required to withhold

any tax then a minimum payment of $2,000 will still be made.

Businesses that lodge activity statements on a quarterly basis will be eligible to receive the credit for the quarters ending March 2020

and June 2020. Business that lodge on a monthly basis will be eligible for the credit for the March 2020, April 2020, May 2020 and June

2020 lodgments. The minimum $2,000 payment will be applied to the first lodgement. Eligibility for the measure will be based on prior year

turnover. We will have to wait for the legislation for the finer details.

Wage subsidy of up to 50% of an apprentice or trainee wage

Eligible employers can apply for a wage subsidy of 50% of the apprentice's or trainee's wage for up to 9 months from 1 January 2020 to 30

September 2020. The payments are accessible to businesses with less than 20 employees. Employers will receive up to $21,000 per apprentice

($7,000 per quarter). Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer that

employs that apprentice.

In order to qualify for this payment the apprentice or trainee must have been in training with the business as at 1 March 2020. Employers

of any size and Group Training Organisations that re-engage an eligible out-of-trade apprentice or trainee will also be eligible for the

subsidy. It is expected that employers will be able to register for the subsidy from early April 2020. Final claims for payment must be

lodged by 31 December 2020.

Targeted support for severely affected sectors, regions and communities

$1 billion has been committed to support sectors, regions and communities disproportionately affected by the economic impact of the coronavirus. Tourism, agriculture and education are specifically mentioned. Initial measures include:

- Waiver of fees and charges for tourism businesses that operate in the Great Barrier Reef Marine Park and Commonwealth National Parks

- Additional assistance to help businesses identify alternative export markets or supply chains

- Measures to promote domestic tourism

Further plans and measures will be developed with the affected industries and communities. Administrative relief for certain tax obligations will also be provided, including deferred tax payments up to four months. The ATO will establish a temporary shop front in Cairns within the next few weeks to support the region's small businesses. Other initiatives to bring support to the communities are being considered.

Household stimulus payments to drive cash into the economy

Tax-free $750 payment to social welfare recipients.

A one-off, $750 cash payment will be made to pensioners, social security, veteran and other income support recipients and eligible

concession card holders. Payments will be from 31 March 2020 on a progressive basis, 90% are expected to be made by mid-April. The payment

will be tax-free and will not count as income for Social Security, Farm Household Allowance and Veteran payments. There will be one payment

per eligible recipient even if they qualify in multiple ways.

Casual employees able to access the Newstart 'sickness payment'

While not part of the stimulus package, the Prime Minister has stated that casual employees required to self-isolate or who contract the

coronavirus will be eligible for a sickness payment (jobseeker payment) through Newstart. The normal waiting period for this payment will

be waived.

We'll bring you more details as soon as they become available.

Any advice contained in this material is General Advice and does not take into account any person's individual investment objectives, financial situation or needs. Any representations, opinions or statements are based on our understanding of the relevant legislation as at the date of issue. Although every effort has been made to verify the accuracy of the information contained in this material, Forsyths Business Services, its officers, representatives, employees and agents disclaim all liability (except for any liability which by law cannot be excluded), for any error, inaccuracy in, or omission from the information contained in this material or any loss or damage suffered by any person directly or indirectly through relying on this information. Accounting & Business Services are provided by Forsyths Business Services Pty Ltd ABN 66 182 781 401, liability is limited under a scheme approved under Professional Standards Legislation.