News

Forsyths Principals Retreat: Planning for Success

Each year, our Forsyths Principals come together for a dedicated four-day retreat—a valuable opportunity to strategise for the year ahead, analyse industry trends, and set new goals to support our business, our clients, and our people. This year, our team traveled to the stunning coastal region of Port Stephens for an inspiring and productive retreat.

Introducing Forsyths Investment Portfolios

We are excited to introduce a new investment service for our clients - the Forsyths Multi-Asset and Income Portfolios.

Threshold for tax-free retirement super increases

The amount of money that can be transferred to a tax-free retirement account will increase to $2m on 1 July 2025.

Is there a problem paying your super when you die?

The Government has announced its intention to introduce mandatory standards for large superannuation funds to, amongst other things, deliver timely and compassionate handling of death benefits. Do we have a problem with paying out super when a member dies?

Will credit card surcharges be banned?

If credit card surcharges are banned in other countries, why not Australia? We look at the surcharge debate and the payment system complexity that has brought us to this point.

Why the ATO is targeting babyboomer wealth

The Australian Taxation Office (ATO) thinks that wealthy babyboomer Australians, particularly those with successful family-controlled businesses, are planning and structuring to dispose of assets in a way in which the tax outcomes might not be in accord with the ATO’s expectations.

Investing in the Future: Forsyths Sponsors Financial Literacy for Calrossy Students

At Forsyths, we believe that financial literacy is a cornerstone for future success, which is why we are proud to sponsor the Lifeskills Academy for Calrossy Year 10 students in 2025.

RBA Announces First Rate Cut Since 2020

For the first time since 2020, the Reserve Bank of Australia (RBA) has announced a rate cut, reducing the cash rate target to 4.10%. This decision signals confidence in the Australian economy’s stability but will have different implications depending on your financial situation.

Welcoming Steve Thomson to Forsyths

We are delighted to introduce Steve Thomson, who joined Forsyths in February as our new Director of Financial Services. With over 30 years of experience in the financial services industry, Steve brings a wealth of expertise, leadership, and strategic insight that will further strengthen our team and the services we provide to our clients.

Stay Alert: Counterfeit Cash Circulating in Local Businesses

While the saying "cash is king" still holds true for many businesses, recent incidents of counterfeit banknotes have been discovered in EBD (Electronic Bulk Deposit) bags by Armaguard highlight the risks of handling physical money.

Halfway Through the Taxation Year: The Power of Planning

As the calendar flips to the second half of the taxation year, many business owners find themselves caught in the whirlwind of day-to-day

operations. For some, this period feels like just another checkpoint; for others, it’s a wake-up call to take control of their financial

strategies.

This is the story of David, the owner of a growing manufacturing business. Like many entrepreneurs, David started the year with ambitious goals but soon got swept up in the demands of managing his team, fulfilling orders, and keeping customers happy. By the time he realised it, the year was already half over, and he hadn’t yet revisited his business plan.

Supporting the Next Generation: Forsyths and the Gunnedah Community Scholarship Fund

At Forsyths, we believe that investing in the next generation is key to building strong, vibrant communities. That’s why we are proud to support the Gunnedah Community Scholarship Fund, an initiative that has been making a tangible difference in the lives of young people for more than 20 years.

What’s ahead in 2025?

The last few years have been a rollercoaster ride of instability. 2025 holds hope, but not a guarantee, of greater stability and certainty. We explore some of the key changes and challenges.

Ricky Goel Shines Bright at the Rising Star Awards 2024

We are thrilled to share that Ricky Goel has won the Audit category at the 2024 Rising Star Awards in Sydney on Friday 22nd November.

Bah humbug: The Christmas tax dilemma

Don’t want to pay tax on Christmas? Here are our top tips to avoid giving the Australian Tax Office a bonus this festive season.

What makes or breaks Christmas?

The cost of living has eased over the past year but consumers are still under pressure. For business, planning is the key to

managing Christmas volatility.

The countdown to Christmas is on and we’re in the midst of a headlong rush to maximise any remaining opportunities before the Christmas

lull. Busy period or not, Christmas causes a period of dislocation and volatility for most businesses. The result is that it is not

‘business as usual’ and for many, volatility can create problems.

Are student loans too big?

Australian voters tend to reject US style education favouring more egalitarian systems where income does not determine access. For Australian domestic students, the cost of completing a bachelor degree is generally between $20,000 and $45,000, excluding some of the higher value courses

Finalist Award Recognition

We are thrilled to announce that Ricky Goel and Rodney Wark have been recognised as finalists in their recent industry awards submission for 2024!

Growth and Dedication at Forsyths

At Forsyths, growth and dedication are at the heart of everything we do. We pay tribute to the incredible career of Megan Edwards, who has retired after 31 years of dedicated service and are proud to announce Diane McLeod's promotion to Director of Leadership and Development.

Tax Consequences of Inheriting Property

Beyond the difficult task of dividing up your assets and determining who should get what, it’s essential to look at the tax consequences of how your assets will flow through to your beneficiaries.

More women using ‘downsizer’ contributions to boost super

If you are aged 55 years or older, the downsizer contribution rules enable you to contribute up to $300,000 from the proceeds of the sale of your home to your superannuation fund (eligibility criteria applies).

Payday super: the details

Payday super’ will overhaul the way in which superannuation guarantee is administered. We look at the first details and the

impending obligations on employers.

From 1 July 2026, employers will be obligated to pay superannuation guarantee (SG) on behalf of their employees on the same day as salary

and wages instead of the current quarterly payment sequence.

Beyond Profits: How Community Engagement Fuels Business Growth

In today’s fast-paced world, businesses are relentlessly focused on growth, reducing costs, and chasing targets. But amid this drive for success, one powerful objective is often overlooked in a business strategy and that’s community engagement.

$81.5m payroll tax win for Uber

Multinational ride-sharing system Uber has successfully contested six Revenue NSW payroll tax assessments totalling over $81.5 million. The assessments were issued on the basis that Uber drivers were employees and therefore payroll tax was payable.

Property and ‘lifestyle’ assets in the spotlight

Own an investment property or an expensive lifestyle asset like a boat or aircraft? The ATO are looking closely at these assets to see if what has been declared in tax returns matches up.

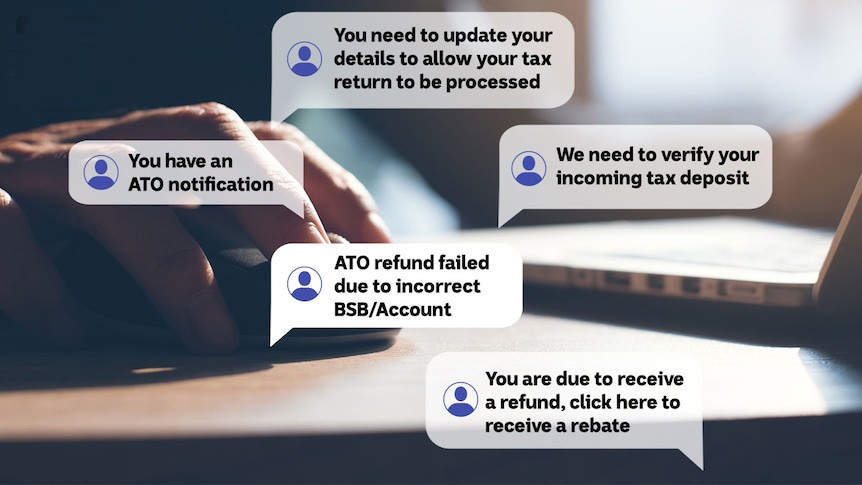

It wasn’t me: the tax fraud scam

You login to your myGov account to find that your activity statements for the last 12 months have been amended and GST credits of $100k issued. But it wasn’t you. And you certainly didn’t get a $100k refund in your bank account. What happens now?

The rise in business bankruptcy

ASIC’s annual insolvency data shows corporate business failure is up 39% compared to last financial year. The industries with the highest representation were construction, accommodation and food services at the top of the list.

Divorce, you, and your business

Breaking up is hard to do. Beyond the emotional and financial turmoil divorce creates, there are a number of issues that need to be resolved.

When is a gift not a gift?

The Tax Commissioner has successfully argued that more than $1.6m deposited in a couple’s bank account was assessable income, not a gift or a loan from friends.

Celebrating Team Member Promotions

This month we celebrate over 15 employees who have recently received a promotion with Forsyths.

What’s changing on 1 July 2024?

Here’s a summary of the key changes coming into effect on 1 July 2024:

ATO fires warning shot on trust distributions

The ATO has warned that it is looking closely at how trusts distribute income and to who. The way in which trusts distribute income has come under intense scrutiny in recent years. Trust distribution arrangements need to be carefully considered by trustees before taking steps to appoint or distribute income to beneficiaries.

$20k instant asset write-off passes Parliament

Legislation increasing the instant asset write-off threshold from $1,000 to $20,000 for the 2024 income year passed Parliament just 5 days prior to the end of the financial year.

Hiring New Staff

When hiring new staff, there are certain steps you should follow to cover off on your tax, workplace, and superannuation obligations.

Don’t lose your super to scammers

Don’t be another victim – be on the lookout for scammers who call you about your superannuation!

What’s not considered “income” by the ATO?

It is possible to receive amounts that are not expected by the ATO to be included as income in your tax return. However some of these amounts may be used in other calculations and may therefore need to be included elsewhere in your tax return.

Personal services income explained

The personal services income (PSI) rules apply to income that is earned mainly from the personal efforts or skills of a person.

Federal Budget 2024-25

The Federal Budget for 2024-25 was handed down on Tuesday 14 May 2024. It contains a range of proposed measures across the areas of income tax, superannuation, tax administration and related cost of living measures.

Forsyths Welcomes Our Next Custodian

David McLennan steps in as Managing Principal, Continuing the Legacy of Leadership as our next Custodian.

The Forsyths Foundation announces 2024 Charitable Recipients

As part of their company-wide efforts, the Forsyths Foundation annually donates to charities that offer valuable support or services to the communities that Forsyths serve. Here are the 2024 deserving recipients.

Succession Planning for Family Businesses

For most family businesses as well as private groups, succession planning (sometimes known as transition planning) involves considerations around the eventual sale of your business, or the passing of control of it to other family members when you retire.

Rental Properties: Traps and pitfalls

Following the ATO’s claims that nine out of ten residential rental property investors who have been audited have been getting their returns wrong, it might be worth touching on some of the tax traps and pitfalls to be wary of.

Take Care With Contribution Timing This Financial Year

Are you are planning to maximise your superannuation contribution caps this financial year? If so, it’s crucial to get the timing right so your contribution is received by your superannuation fund in the current financial year.

Selling Your Home? Beware of a Partial Capital Gains Tax Liability!

With the temptation for homeowners to cash in on spiralling house prices around Australia, it is important to turn your mind to whether you may only have a partial capital gains tax (CGT) main residence exemption available to you, and not a full CGT exemption (because of the way you have used your home).

Mortgage vs super: Where should I put my extra cash?

Many of us wonder about the best vehicle to use for our extra savings. Is it better to direct extra savings to your mortgage or superannuation? As with most financial decisions, there is no one-size-fits-all approach as it depends on a number of factors for each individual.

Family companies and the many tax traps

If you own a family company, then it is very important how you receive and treat any payments made from the company to you (or your associates – for example, your spouse).

Six super strategies to consider before 30 June 2024

With the end of financial year fast approaching, now is a great time to boost your superannuation savings and potentially save on tax.

Cyber attacks and scams

In an increasingly digital world, cyber security has become a critical concern for our clients. By understanding the risks posed by cyber threats and scams, and by implementing proactive security measures, clients can safeguard themselves from the potentially devastating consequences of falling victim to a scam or a cyber breach.

RAA update on the August/September 2022 Flood Grants

If you have been approved for a Special Disaster Grant or Rural Landholder Grant for the floods that occurred from August/September 2022 and you haven’t yet claimed the maximum approved grant amount, you can still submit additional invoices to claim via the RAA website.

Super Contribution Caps to Increase on 1 July

For the first time in three years, the superannuation contributions are set to increase from 1 July 2024.

Stage 3 Tax Cuts: A Tax Saving opportunity

Many taxpayers and their advisers focus on timing issues around year-end by deferring income and bringing forward deductions.

Cyber Attacks & Scams

In an increasingly digital world, cyber security has become a critical concern for our clients. By understanding the risks posed by cyber threats and scams, and by implementing proactive security measures, clients can safeguard themselves from the potentially devastating consequences of falling victim to a scam or a cyber breach.

Nurturing Financial Growth and Community Prosperity in Regional Australia

Nurturing Financial Growth and Community Prosperity in Regional Australia In a recent interview with Regional Australia Bank, our Managing Director of Forsyths, Andrew Kirk, shares the story behind this esteemed financial institution and its commitment to both financial excellence and community well-being.

Sharing information and knowledge that are relevant can help foster more creative solutions

They say there are only two certainties in life: death and taxes. But in the world of financial services, we know there are a few more!

Returning to Work After Retirement

Most people look forward to retirement as it is a chance to finally take time to relax, enjoy life and do things they never had time for when they were working.

Collectables – and inherited jewellery

The ATO knows that many business owners naturally help themselves to their trading stock and use it for their own purposes.

Tax issues when dealing with volunteers

From bushfire relief groups, sporting clubs, environmental groups, charity associations and many more, volunteers are an indispensable workforce and support network for many organisations. For most, if not all, having volunteers ready to lend a hand is pivotal in them being able to function or survive.

Forsyths Spreads Joy this Christmas with their Build a Bike for Charity Initiative

Forsyths, a leading regional Accounting and Financial Services firm, recently celebrated its annual Firm Day, by blending team building with community giving. The unique event brought together teams from their five regional locations to assemble 15 bicycles from scratch, each destined to bring holiday cheer to families in need.

Don't Ignore Those Tax Debts: The ATO Won't!

Whilst the ATO went out of its way to assist businesses doing it tough during the COVID lockdowns, a more robust approach to collecting outstanding tax debts now seems to be the order of the day.

Two "Main Residences" is Possible

The CGT exemption for a person’s home is only available in respect of one home owned at any given time.

Taken Goods for Private Use? Here's the Latest Values

The ATO knows that many business owners naturally help themselves to their trading stock and use it for their own purposes.

Lost or Destroyed Tax Records? Don't Panic!

Now and then, taxpayers may find themselves in a situation where they simply have no records to back up a tax claim.

Give Yourself a Super Gift This Christmas

Give yourself the ultimate gift that doesn't cost a thing – a super to-do list which is a gift that will benefit you now and in the future.

Adapting to changing weather and economic conditions

Staying ahead of the curve is essential. As we continue to witness the impact of changing weather patterns and economic fluctuations on farming operations, it becomes increasingly clear that adopting smart financial farming strategies is not just beneficial - it's crucial

Cyber-attacks

Cyber-attacks are always prevalent and reaching the news headlines more and more frequently. Bad actors can do a lot of damage to your data and systems. And they're always finding new ways to break in. So, at Forsyths we urge you to be careful and protect yourself online.

How to nominate a superannuation beneficiary

There are many types of nominations offered by different funds. Knowing which one suits your circumstances is key to ensure your superannuation ends up in the right hands.

Qualifying as an interdependent or financial dependant

A question that often gets asked when dealing with death benefit nominations is whether a person will qualify under the interdependency or financial dependency definitions. This is an important consideration as meeting the dependency criteria will enable potential beneficiaries to qualify as a dependant and therefore allow them to receive a death benefit.

When two bonuses are not enough... Introducing the Energy Incentive!

If you’ve been putting off upgrading the inefficient office air-conditioner, a new 20% bonus deduction might just be the incentive you need to help beat the heat before it arrives with a vengeance!

Who is a resident for tax purposes?

A person’s residency for tax purposes can be one of the most difficult issues to determine in Australian tax law. And it is not just a question of whether a person is a ‘citizen’ of Australia.

Are you eligible to make a personal deductible contribution?

Personal deductible contributions can allow individuals to claim a tax deduction for contributions they have made to superannuation provided they meet certain requirements. So what are these requirements and what should you look out for?

Don’t overlook the CGT small business roll-over concession

The CGT small business concessions are invaluable to those who make a capital gain from a small business. They can eliminate a gain entirely; they can reduce a gain; and they can allow for the gain to be CGT-free if paid into a superannuation fund.