News

Growth and Dedication at Forsyths

At Forsyths, growth and dedication are at the heart of everything we do. We pay tribute to the incredible career of Megan Edwards, who has retired after 31 years of dedicated service and are proud to announce Diane McLeod's promotion to Director of Leadership and Development.

Tax Consequences of Inheriting Property

Beyond the difficult task of dividing up your assets and determining who should get what, it’s essential to look at the tax consequences of how your assets will flow through to your beneficiaries.

More women using ‘downsizer’ contributions to boost super

If you are aged 55 years or older, the downsizer contribution rules enable you to contribute up to $300,000 from the proceeds of the sale of your home to your superannuation fund (eligibility criteria applies).

Payday super: the details

Payday super’ will overhaul the way in which superannuation guarantee is administered. We look at the first details and the

impending obligations on employers.

From 1 July 2026, employers will be obligated to pay superannuation guarantee (SG) on behalf of their employees on the same day as salary

and wages instead of the current quarterly payment sequence.

Beyond Profits: How Community Engagement Fuels Business Growth

In today’s fast-paced world, businesses are relentlessly focused on growth, reducing costs, and chasing targets. But amid this drive for success, one powerful objective is often overlooked in a business strategy and that’s community engagement.

$81.5m payroll tax win for Uber

Multinational ride-sharing system Uber has successfully contested six Revenue NSW payroll tax assessments totalling over $81.5 million. The assessments were issued on the basis that Uber drivers were employees and therefore payroll tax was payable.

Property and ‘lifestyle’ assets in the spotlight

Own an investment property or an expensive lifestyle asset like a boat or aircraft? The ATO are looking closely at these assets to see if what has been declared in tax returns matches up.

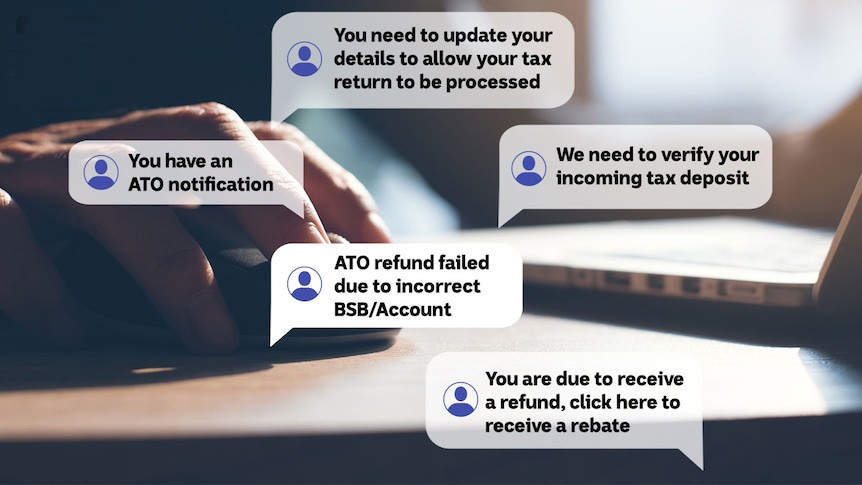

It wasn’t me: the tax fraud scam

You login to your myGov account to find that your activity statements for the last 12 months have been amended and GST credits of $100k issued. But it wasn’t you. And you certainly didn’t get a $100k refund in your bank account. What happens now?

The rise in business bankruptcy

ASIC’s annual insolvency data shows corporate business failure is up 39% compared to last financial year. The industries with the highest representation were construction, accommodation and food services at the top of the list.

Divorce, you, and your business

Breaking up is hard to do. Beyond the emotional and financial turmoil divorce creates, there are a number of issues that need to be resolved.

When is a gift not a gift?

The Tax Commissioner has successfully argued that more than $1.6m deposited in a couple’s bank account was assessable income, not a gift or a loan from friends.

Celebrating Team Member Promotions

This month we celebrate over 15 employees who have recently received a promotion with Forsyths.

What’s changing on 1 July 2024?

Here’s a summary of the key changes coming into effect on 1 July 2024:

ATO fires warning shot on trust distributions

The ATO has warned that it is looking closely at how trusts distribute income and to who. The way in which trusts distribute income has come under intense scrutiny in recent years. Trust distribution arrangements need to be carefully considered by trustees before taking steps to appoint or distribute income to beneficiaries.

$20k instant asset write-off passes Parliament

Legislation increasing the instant asset write-off threshold from $1,000 to $20,000 for the 2024 income year passed Parliament just 5 days prior to the end of the financial year.

Hiring New Staff

When hiring new staff, there are certain steps you should follow to cover off on your tax, workplace, and superannuation obligations.

Don’t lose your super to scammers

Don’t be another victim – be on the lookout for scammers who call you about your superannuation!

What’s not considered “income” by the ATO?

It is possible to receive amounts that are not expected by the ATO to be included as income in your tax return. However some of these amounts may be used in other calculations and may therefore need to be included elsewhere in your tax return.

Personal services income explained

The personal services income (PSI) rules apply to income that is earned mainly from the personal efforts or skills of a person.

Federal Budget 2024-25

The Federal Budget for 2024-25 was handed down on Tuesday 14 May 2024. It contains a range of proposed measures across the areas of income tax, superannuation, tax administration and related cost of living measures.

Forsyths Welcomes Our Next Custodian

David McLennan steps in as Managing Principal, Continuing the Legacy of Leadership as our next Custodian.

The Forsyths Foundation announces 2024 Charitable Recipients

As part of their company-wide efforts, the Forsyths Foundation annually donates to charities that offer valuable support or services to the communities that Forsyths serve. Here are the 2024 deserving recipients.

Succession Planning for Family Businesses

For most family businesses as well as private groups, succession planning (sometimes known as transition planning) involves considerations around the eventual sale of your business, or the passing of control of it to other family members when you retire.

Rental Properties: Traps and pitfalls

Following the ATO’s claims that nine out of ten residential rental property investors who have been audited have been getting their returns wrong, it might be worth touching on some of the tax traps and pitfalls to be wary of.

Take Care With Contribution Timing This Financial Year

Are you are planning to maximise your superannuation contribution caps this financial year? If so, it’s crucial to get the timing right so your contribution is received by your superannuation fund in the current financial year.

Selling Your Home? Beware of a Partial Capital Gains Tax Liability!

With the temptation for homeowners to cash in on spiralling house prices around Australia, it is important to turn your mind to whether you may only have a partial capital gains tax (CGT) main residence exemption available to you, and not a full CGT exemption (because of the way you have used your home).

Mortgage vs super: Where should I put my extra cash?

Many of us wonder about the best vehicle to use for our extra savings. Is it better to direct extra savings to your mortgage or superannuation? As with most financial decisions, there is no one-size-fits-all approach as it depends on a number of factors for each individual.

Family companies and the many tax traps

If you own a family company, then it is very important how you receive and treat any payments made from the company to you (or your associates – for example, your spouse).

Six super strategies to consider before 30 June 2024

With the end of financial year fast approaching, now is a great time to boost your superannuation savings and potentially save on tax.

Cyber attacks and scams

In an increasingly digital world, cyber security has become a critical concern for our clients. By understanding the risks posed by cyber threats and scams, and by implementing proactive security measures, clients can safeguard themselves from the potentially devastating consequences of falling victim to a scam or a cyber breach.

RAA update on the August/September 2022 Flood Grants

If you have been approved for a Special Disaster Grant or Rural Landholder Grant for the floods that occurred from August/September 2022 and you haven’t yet claimed the maximum approved grant amount, you can still submit additional invoices to claim via the RAA website.

Super Contribution Caps to Increase on 1 July

For the first time in three years, the superannuation contributions are set to increase from 1 July 2024.

Stage 3 Tax Cuts: A Tax Saving opportunity

Many taxpayers and their advisers focus on timing issues around year-end by deferring income and bringing forward deductions.

Cyber Attacks & Scams

In an increasingly digital world, cyber security has become a critical concern for our clients. By understanding the risks posed by cyber threats and scams, and by implementing proactive security measures, clients can safeguard themselves from the potentially devastating consequences of falling victim to a scam or a cyber breach.

Nurturing Financial Growth and Community Prosperity in Regional Australia

Nurturing Financial Growth and Community Prosperity in Regional Australia In a recent interview with Regional Australia Bank, our Managing Director of Forsyths, Andrew Kirk, shares the story behind this esteemed financial institution and its commitment to both financial excellence and community well-being.

Sharing information and knowledge that are relevant can help foster more creative solutions

They say there are only two certainties in life: death and taxes. But in the world of financial services, we know there are a few more!

Returning to Work After Retirement

Most people look forward to retirement as it is a chance to finally take time to relax, enjoy life and do things they never had time for when they were working.

Collectables – and inherited jewellery

The ATO knows that many business owners naturally help themselves to their trading stock and use it for their own purposes.

Tax issues when dealing with volunteers

From bushfire relief groups, sporting clubs, environmental groups, charity associations and many more, volunteers are an indispensable workforce and support network for many organisations. For most, if not all, having volunteers ready to lend a hand is pivotal in them being able to function or survive.

Forsyths Spreads Joy this Christmas with their Build a Bike for Charity Initiative

Forsyths, a leading regional Accounting and Financial Services firm, recently celebrated its annual Firm Day, by blending team building with community giving. The unique event brought together teams from their five regional locations to assemble 15 bicycles from scratch, each destined to bring holiday cheer to families in need.

Don't Ignore Those Tax Debts: The ATO Won't!

Whilst the ATO went out of its way to assist businesses doing it tough during the COVID lockdowns, a more robust approach to collecting outstanding tax debts now seems to be the order of the day.

Two "Main Residences" is Possible

The CGT exemption for a person’s home is only available in respect of one home owned at any given time.

Taken Goods for Private Use? Here's the Latest Values

The ATO knows that many business owners naturally help themselves to their trading stock and use it for their own purposes.

Lost or Destroyed Tax Records? Don't Panic!

Now and then, taxpayers may find themselves in a situation where they simply have no records to back up a tax claim.

Give Yourself a Super Gift This Christmas

Give yourself the ultimate gift that doesn't cost a thing – a super to-do list which is a gift that will benefit you now and in the future.

Adapting to changing weather and economic conditions

Staying ahead of the curve is essential. As we continue to witness the impact of changing weather patterns and economic fluctuations on farming operations, it becomes increasingly clear that adopting smart financial farming strategies is not just beneficial - it's crucial

Cyber-attacks

Cyber-attacks are always prevalent and reaching the news headlines more and more frequently. Bad actors can do a lot of damage to your data and systems. And they're always finding new ways to break in. So, at Forsyths we urge you to be careful and protect yourself online.

How to nominate a superannuation beneficiary

There are many types of nominations offered by different funds. Knowing which one suits your circumstances is key to ensure your superannuation ends up in the right hands.

Qualifying as an interdependent or financial dependant

A question that often gets asked when dealing with death benefit nominations is whether a person will qualify under the interdependency or financial dependency definitions. This is an important consideration as meeting the dependency criteria will enable potential beneficiaries to qualify as a dependant and therefore allow them to receive a death benefit.

When two bonuses are not enough... Introducing the Energy Incentive!

If you’ve been putting off upgrading the inefficient office air-conditioner, a new 20% bonus deduction might just be the incentive you need to help beat the heat before it arrives with a vengeance!

Who is a resident for tax purposes?

A person’s residency for tax purposes can be one of the most difficult issues to determine in Australian tax law. And it is not just a question of whether a person is a ‘citizen’ of Australia.

Are you eligible to make a personal deductible contribution?

Personal deductible contributions can allow individuals to claim a tax deduction for contributions they have made to superannuation provided they meet certain requirements. So what are these requirements and what should you look out for?

Don’t overlook the CGT small business roll-over concession

The CGT small business concessions are invaluable to those who make a capital gain from a small business. They can eliminate a gain entirely; they can reduce a gain; and they can allow for the gain to be CGT-free if paid into a superannuation fund.

Small business skills and training boost

Looking to boost your employees’ skills and your tax deductions at the same time? Then keep reading to see if you could be eligible for the small business skills and training boost!

Property developers – and would-be ones – beware!

For property developers (or would-be property developers) a recent decision of the Federal Court may be of interest.

Changes to unfair contract terms laws: What businesses need to know

Soon to be implemented changes to the Australian Consumer Law will provide additional protection to consumers and small businesses prohibiting the proposal, use or reliance on unfair contract terms in standard form contracts.

How to reduce your income tax bill using superannuation

Did you know you can reduce your income tax by making a large personal tax-deductible contribution from your take-home pay to your super? This strategy may be particularly useful if you will be earning more income this financial year or if you have sold an asset this year and made a large capital gain.

Costs of a caravan/motor home for work-related travel

In these challenging and changing times, many have jumped on the modern version of the proverbial band wagon and purchased a caravan or motor home to use for work or business-related travel.

Appointing an SMSF auditor

Early last month, the ATO issued a reminder around auditors. If you have an SMSF, you need to appoint an approved SMSF auditor for each income year, no later than 45 days before you need to lodge your SMSF annual return (SAR).

Discounting your capital gain

The capital gains tax (CGT) discount can reduce by 50% a capital gain that you make when you dispose of (sell) a CGT asset that you have owned for 12 months or more.

Avoid schemes targeting SMSFs

Sometimes promoters of schemes target self-managed super funds (SMSFs). Schemes can include tax avoidance arrangements that inappropriately channel money or assets into your SMSF so you pay less tax. They may also include arrangements promoting the illegal early release of benefits from your fund for personal use.

Self-education: when is it deductible?

If the subject of self-education leads to, or is likely to lead to, an increase in the taxpayer’s income from current (but not new) income-earning activities, a deduction for self-education expenses incurred will be allowable.

Thought of registering a trademark for your new business?

The ATO has issued a reminder around trademarks! For background, a trademark legally protects your brand and helps customers distinguish your products or services in the market from others. Trademarks can be used to protect a logo, phrase, word, letter, colour, sound, smell, picture, movement, aspect of packaging or any combination of these. In short, they protect your brand, products and services.

R&D reminder

The ATO has issued a reminder for companies wishing to claim a tax offset for their R&D (research and development) activities. The reminder was issued in the context of the ATO’s success in the Federal Court decision T.D.S. Biz Pty Ltd v FCT.

SMSFs & higher interest rates

SMSF trustees with limited recourse borrowing arrangements (LRBAs) are now feeling the impact of ten interest rate rises since May 2022 in one hit, from July 2023.

Gifting to employees

Some employers, especially at Christmas time or for birthdays, give small gifts to their employees or the employee’s associates (i.e. spouses). These gifts typically take the form of bottles of wine, movie tickets, gift vouchers etc.

Trusts – are they still worth it?

The recent ATO crackdown on trusts will no doubt have some business owners (and even some advisors) asking themselves the question: Is this structure for business purposes still worth it?

Tax Time: Unexpected first-time debts

For the first time, many Australians are finding themselves in a position where they are being told they owe the ATO money after completing their tax return this year.

Forsyths Foundation Contributes $15,000 to Local Charities

The Forsyths Foundation, established in 2015 by Forsyths, the leading accounting and financial services firm in regional NSW, is proud to announce its continued commitment to supporting local communities through its annual donation program.

Work-Related Car Expenses Updated

The ATO has just announced that the cents per kilometre rate has increased to 85 cents per kilometre for 2023/24.

Small Business Lodgement Amnesty

Since Budget night, the ATO has released more information around the small business lodgment amnesty…which can now be taken advantage of from 1 June 2023!

Fair Work Changes

Although not related to tax, there are a number of changes on the Fair Work front that employers should be aware of.

Time for a Restructure?

The new financial year can be a time where business owners look at their operating structure and consider whether it still meets their needs.

Superannuation and the Right to Delegate

Another key Federal Court case may have a bearing on whether you owe certain workers you engage superannuation guarantee or not.

Super Guarantee Increases 11%

The increase to the superannuation guarantee (SG) rate from 1 July 2023 will see more employees (and certain contractors) entitled to additional SG contributions on their pay.

Maximising cashflow

The predicted slowing of the economy in 2023-24 along with the pay day super guarantee (SG) proposal are sure to make cashflow more important than ever for business over the coming months and years, noting that it is one of the biggest difficulties faced by business.

What are the types of super funds you can contribute to?

With the total superannuation sector worth more than $3.5 trillion at the end of March 2023, superannuation is serious business. There are many types of superannuation funds available but sometimes having too many to choose from can be confusing. However, picking the right fund is important as it could impact how much you may have to retire on in the future.

Do you have a side-hustle?

With the cost-of-living skyrocketing, have you taken up a side-hustle? With new and emerging ways to make money, the ATO is reminding taxpayers to consider if they are ‘in business’ and to declare to their tax agent if they are engaged in a side-hustle.

Generous depreciation in its final days

This month’s federal budget confirmed that temporary full expensing (TFE) is now in its final days. To recap, TFE will cease and be replaced by a $20,000 instant asset write-off (IAWO) from 1 July 2023.

Super pensions and the Commonwealth Seniors Health Card

Are you a self-funded retiree who does not qualify for the Age Pension? If you’ve answered yes, then help may be available for certain living expenses by way of the Commonwealth Seniors Health Card (CSHC).

ATO Tax Time focus areas

With the end of the financial year on our doorstep, the ATO has announced its three key focus areas for 2022-23 Tax Time – rental property deductions, workrelated expenses, and capital gains tax (CGT). To maximise your claims in this area and protect yourself from ATO audits and adjustments, be sure to keep the appropriate records.

2023-24 Budget Wrap

The 2023-24 Federal Budget was handed down on 9 May. It contains changes to business and personal taxation, superannuation, social security entitlements, as well as cost of living relief. Following are some of the headline measures, many of which are subject to enabling legislation.

Temporary Full Expensing: get in quick!

This could be the final opportunity for your business to take advantage of Temporary Full Expensing (TFE)…but get in before 1 July!

Upcoming trust distribution strategies –latest developments

If you run your business through a family trust, there’s some good news on the distribution front.

Financing motor vehicles in 2023

One of the most common decisions facing business is how to finance and account for the acquisition of a motor vehicle. There are numerous ways of doing so, with each resulting in differing accounting, taxation and GST treatment.

How to claim an early tax deduction on SG contributions

Are you an employer who needs to make superannuation guarantee (SG) contributions for your employees? If so, it may be worthwhile bringing forward these SG contributions to before 1 July to benefit from a tax deduction this financial year.

New reporting arrangements for SMSFs from 1 July 2023

From 1 July 2023, trustees and directors of SMSFs must report certain events that affect their members transfer balance account quarterly.

The journey to success is a marathon, not a sprint

While deciding what to write this month for the Coonabarabran Times, I couldn’t believe that it has been nearly 12 months since starting out on this journey. Throughout the course of the year I have come to realise how much I’ve learnt about the process of story-telling, which is not an accountant’s natural skillset.

Does it all add up?

As the end of another financial year approaches, conversations around taxes are back on again. Cost of living is up across the board and so on top of all of this it’s no fun to add to it with taxes.

Lost super

Did you know there is around $16 billion in lost and unclaimed superannuation across Australia? The ATO recently indicated this is an increase of $2.1 billion since last financial year and is urging Australians to check their account to see if some of the money is theirs.

Fending off GST audits

The Government has welcomed the actions of an ATO-led taskforce in relation to what is termed “the biggest GST fraud in Australia’s history”.

Reducing the risk of crypto scams

ASIC has released fresh and timely information around crypto scams.

FBT exemption for electric vehicles

With car fringe benefits one of the most common benefits provided by employers to employees, a new ATO fact sheet shines more light on the FBT exemption for electric vehicles.

Proposed tax on $3m super balances

Individuals with large superannuation balances may soon be subject to an extra 15% tax on earnings if their balance exceeds $3m at the end of a financial year.

Trust distribution landscape now more settled

If you carry on your business affairs through a trust structure, there is now more clarity around the law on distributions following much uncertainty throughout the year.

Legislating the purpose of superannuation

On 20 February 2023, Treasury released a consultation paper on legislating the purpose of superannuation. This is an idea that has been around since 2016 when the former Coalition government contemplated doing the same thing.

FBT and car logbooks

With the end of the FBT year approaching, are your car logbooks in order? The operating cost method is used by many employers to calculate their car FBT liability. This method is particularly effective where the business use of the vehicle is high. Keeping a logbook is essential to use the operating cost method.

New work from home record keeping requirements

Are you one of the five million Australians who claim work from home deductions? If so, stricter record-keeping rules may now apply.

Crystalising capital losses

It’s been a particularly difficult 12 months for investors. On the superannuation front, we now have two major reports assessing how super accounts fared in the 2022 calendar year. SuperRatings issued its average balanced return recently and found it was minus 4.8%.

PAYG instalment variations

The ATO is encouraging accountants to educate clients around varying PAYG instalments – this can potentially assist cashflow.

An investment in knowledge pays the best interest

We are well and truly rolling ahead in 2023 now, another year where we might’ve thought we wouldn’t be quite as busy as last year, which hasn’t proved to be the case yet.

ATO finalises Section 100A guidance for Family Trusts

Do you operate your business via a family trust? The ATO released its final guidance material on the application of section 100A on 8 December 2022 – TR2022/4 and PCG 2022/2. In doing so, it has fortunately clarified a number of issues.

Can you use your SMSF property upon retirement?

Many SMSF trustees wonder if they can live in their SMSF property once they retire. This is a common question particularly as property is such a popular SMSF investment.

The importance of cash flow forecasts

As we enter into the new year, with many economists predicting a slowing of theeconomy, planning your business’s cashflow is more important than ever.

Reduction in downsizer eligibility age

The eligibility age for downsizer contributions reduced from 60 to 55 years from 1 January 2023. This means if you are age 55 or older, you could invest the proceeds of the sale of your family home to your superannuation outside of your standard contribution caps.

ATO new-year resolutions

The ATO has released its new year resolutions...and there is not a gym in sight. According to the ATO, the five new year’s resolutions to keep if you want to stay on top of your tax and super in 2023 are 1. Know if you’re in business or not, 2. Keep business details and registrationsup to date, 3. Keep good records, 4. Work out if the PSI rules apply to you and 5. Look after yourself.

Are you ready for paid FDVL?

From 1 February, employers with 15 or more employees must provide 10 days of paid family and domestic violence leave. Is your business ready?

$75,000 Special Disaster Grant Now Open

The NSW and Australian Governments are supporting primary producers impacted by flooding that began on 4 August and/or 14 September 2022, by announcing $75,000 Special Disaster Grants to help pay for immediate clean-up and repairs to infrastructure?

2022-23 Budget 2.0 Summary

With seven months before the 2023-24 Budget is released in May 2023, this recent Budget is a shuffling of the deck not a new set of cards. And to continue the pun, we need to play the hand we have been dealt, buffeted by externalities – war, floods, and global uncertainty.

Cyber Security Awareness

Given October was Cyber Security Awareness month, I thought it was a funny coincidence considering the recent hacking attacks at Optus and myDeal. This is certainly no laughing matter if you were caught up in the data and so it’s a great reminder to think about your security.

Do I have to pay myself super as a business owner?

Do you have your own business or are you thinking of starting one? If so, you may need to pay yourself superannuation depending on your business structure.

Protecting your au domain name

The ATO Commissioner has just issued a warning to businesses on the importance of securing your au domain name!

Rental expenses in excess of income not deductible

With many parts of Australia in the grip of a rental crisis, a significant number of tenants may be residing in the properties of friends and relatives.

Director ID Last Ditch Awareness Campaign

What you need to know

With hundreds of thousands of directors yet to apply for their director identification number (director ID) ahead of the looming November deadline, a last-ditch public information campaign has been launched.

The Albanese Government has just launched a new awareness campaign to help company directors obtain their director ID as the 30 November

deadline quickly approaches.

SMSF member obligations

A recent Administrative Appeals Tribunal decision reminds us all that SMSF trustees (members) can be disqualified where serious breaches, be they advertent or inadvertent, of the super rules are committed.

Claiming business losses

You may be able to offset your business loss against other income (such as salary and wages) if you’re a sole trader or in a partnership.

Optus data breach

Following a recent cyber-attack, Optus customers are advised they could be at risk of identity theft.

Bridging the super gender gap

Fresh statistics released by the ATO reveal that the superannuation gender gap is very real.

Queensland’s new land tax

If you own land in Queensland (or are contemplating making a purchase) and also own other land interstate (or you are contemplating making a purchase) you may soon have an increased land tax liability.